A credit score is a “snapshot” of an individual’s credit history at a particular point in time. Your credit score is meant to illustrate your credit worthiness. Generally, your credit score reflects the information in your credit reports. Take care of your credit history and the information going into your report, then a good credit score will follow.

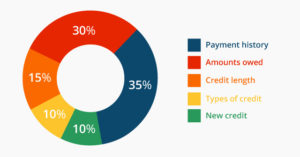

Factors that Determine a Person’s Credit Score:

- Payment history (35%).

- Amount of outstanding debt (30%).

- Length of credit history (15%).

- Types of credit (e.g. credit cards, auto loans, mortgages) (10%).

- How recently you have requested or opened new credit (10%).

Credit scores impact your financial opportunities

Credit scores are used by lenders to determine your credit risk. They are used by lenders to help predict the likelihood that you will be successful in repaying the loan or credit card. Your credit score is considered in a loan approval, the terms you are offered or the rate of interest you will pay for the loan. A higher credit score may mean a lower interest rate resulting in dollars saved over the course of the loan.

Credit scores are crucial

Credit scores are not just for loans and credit cards. Some types of credit scores are compiled by specialty consumer reporting companies. This information is used by entities like insurance carriers to help issue policies and set premium rates for your auto and homeowners insurance. Some employers, landlords and phone companies are using credit scores to assess how you manage financial responsibilities or to provide you with a service and on what terms. A higher credit score generally means you are less of a risk. Therefore, you are more likely to get credit or insurance, and/or pay less for that service.

May I use some of this info for a press release for my local papers?

Good information Glenda. I don’t think most of us realize how much money can be saved in interest and insurance rates if we do a good job of managing credit and maintaining a higher credit score.

Thanks Sheila; It definitely is one way to decrease your expenses in your spending plan.