The holiday season is here and along with the fun and family time, come extra expenses. The holidays can mean extra spending on gifts, travel, charitable giving, decorations, and food for special meals. If you haven’t planned ahead for extra expenses, it can mean swiping the credit card to cover it. The average American spends around $1000 for the holidays.

The holiday season is here and along with the fun and family time, come extra expenses. The holidays can mean extra spending on gifts, travel, charitable giving, decorations, and food for special meals. If you haven’t planned ahead for extra expenses, it can mean swiping the credit card to cover it. The average American spends around $1000 for the holidays.

Tips for Handling Holiday Expenses

- Create a holiday spending plan. Just the way a spending plan for usual expenses helps keep spending under control, creating a holiday budget helps keep expenses down so you know where your money is going.

- Create a list of who you plan to purchase gifts for and set a budget for each person.

- If you are traveling, estimate expenses for gas, hotels, and extra meals eating out.

- Total up expenses to figure out how much you need to set aside each month to save ahead of time or how much you need to set aside to make sure you pay off credit card payments quickly.

Reduce your holiday grocery bill. Food expenses really add up during the holidays so plan ahead to keep those expenses down.

Reduce your holiday grocery bill. Food expenses really add up during the holidays so plan ahead to keep those expenses down.

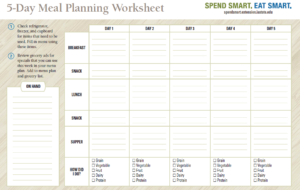

- If you haven’t been meal planning, now is a great time to start.

- Watch for sales and shop ahead of time. This can help reduce your expenses and the stress of last minute shopping.

- Have other family or household members cook something so it isn’t all on you to purchase or prepare everything.

- Repurpose leftovers to make a new dish and prevent wasting food.

- Cut back on gifts. Ultimately the time spent with family during the holidays is the most important gift we can give. If you are trying to cut back on gifts, consider drawing names and doing a gift exchange. You could create a fun gift trading or unwrapping game to do together. An alternative to cutting out gifts altogether is to give an experience through a gift certificate through discount websites like Groupon, Cardpool, or Living Social. Consider spending money on an activity everyone can experience together or donate to a favorite charity.

- Get creative with your gifts. Make gifts instead of purchasing them. A thoughtful handmade gift can mean just as much or more than a purchased gift. Consider artwork, baked goods, or gift certificates for car washes or home cooked meals.

- Bargain Shop – Ahead of Time. This is an obvious tip, but if you leave shopping until the last minute you aren’t very likely to get the best bargains and you might overspend in a panic. If you think ahead about who you need to shop for, you can go straight for the item you are looking for instead of being lured into purchasing things not on the list. Find out if your local stores have online shopping and pick up to prevent filling your cart with extra items.

- Be Realistic. It’s not about the price tag, but the thought and care behind the gift. Aim to keep holiday spending within your means. Don’t make purchases on credit cards you won’t be able to pay off in full when the bill arrives. Try to keep expectations realistic for yourself and those you may be giving to. Maybe you purchase 1 nice gift instead of several gifts. Or you purchase one item and make another. Talking it over ahead of time with the family to set spending limits or rules for gift exchanges can help get everyone on the same page so there won’t be misunderstandings or hurt feelings later.

When we’re in the holiday season, it is easy to overspend and forget about the other costs in our lives. There is a trade off for every purchase we make because when you choose to spend money in one place, it can’t be spent in another. Don’t forget about your long term goals and try to put holiday spending in perspective. No matter how much or how little you spend, you can still have the holiday magic!

Thank you for the great ideas to help with holiday gifts and how to make time with family count!